Think about evaluating your marketing efforts and determining which marketing channels are worth the investment. Your first question will be: “Are acquired leads converting to paid customers? Are those customers retained?”.

To get the most data-driven answers and a clearer view on the overall financial picture, a detailed ARR reporting will be the exact answer you need. In this article, you’ll learn:

- What is ARR in SaaS?

- How to calculate ARR? What’s a good ARR rate?

- How to optimize ARR for your SaaS business?

… and more industry knowledge further down the blog.

Let’s dive in!

What Is ARR in SaaS?

Annual Recurring Revenue (ARR) is a key financial metric in the SaaS industry that represents the predictable and recurring revenue a company expects to generate from its customers over a 12-month period.

(Not to be confused with the Accounting Rate of Return)

This metric includes annualized values of monthly, quarterly, or semi-annual contracts, providing a clear view of a company’s financial health and growth potential. ARR excludes one-time fees and non-recurring income, focusing solely on recurring revenue streams.

In the SaaS business settings, ARR is an important indicator for understanding the long-term value of a customer base and is a critical indicator for investors and stakeholders.

How To Calculate Annual Recurring Revenue (ARR)?

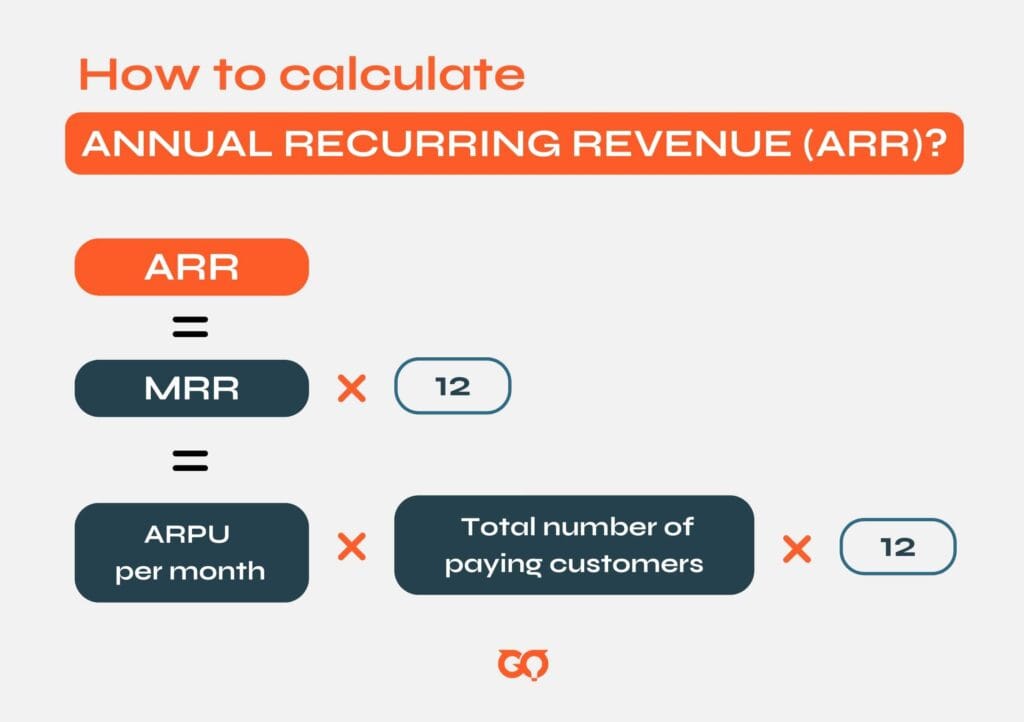

Calculating ARR involves a straightforward formula. When you search for the formula to calculate ARR on Google, however, you might get a bit confused on which formula would be the most accurate and is suitable to implement.

To solve this case, after running through research and consulting with our experts, we’ll go from the most applicable formula for subscription-based SaaS, to some other ones that might integrate better with your business model.

The fundamental equation is taking your Monthly Recurring Revenue (MRR) and multiplying it by a 12-month period:

| ARR = MRR x 12 = (Average revenue per user (ARPU) per month x Total number of paying customers) x 12 |

For example, if your SaaS company has a total of 600 paying customers, and the average monthly revenue per customer is £25, the calculation for ARR would be:

- ARR = (£25 x 600) x 12

- ARR= £15,000×12

- ARR = £180,000

That’s one formula down, let’s go through some common ARR formulas applied by other SaaS companies.

- In an article on ARR by Maxio, the author suggest calculating ARR based on the total of revenue:

ARR = Total revenue of yearly subscriptions + Total revenue gained from add-ons and upgrades + Total revenue lost due to downgrades, cancellations, and churn

- Paddle also has another approach for this metric:

ARR = (Sum of subscription revenue for the year + recurring revenue from add-ons and upgrades) – revenue lost from cancellations and downgrades that year.

What Is a Good ARR Growth Rate For SaaS?

How to calculate ARR growth rate?

| ARR Growth Rate = [(ARR at End of Period – ARR at Beginning of Period)/ARR at Beginning of Period)] ×100 |

Example Calculation:

- ARR at Beginning of Period: $1,000,000

- ARR at End of Period: $1,500,000

Using the formula:

ARR Growth Rate=( 1,500,000−1,000,000)/1,000,000)×100=50%

What does this indicate? A 50% ARR growth rate is a strong indicator that your SaaS business is expanding rapidly. This level of growth suggests that your product or service is well-received in the market and that you are effectively acquiring new customers and/or upselling to existing ones.

The ideal ARR growth rate for SaaS

For a SaaS business, an ideal ARR growth rate typically falls between 20% and 50% per year.

- Below 20%: Growth is insufficient for long-term success, indicating the company may struggle to scale effectively.

- 20% to 50%: This range suggests healthy growth, positioning your business well for sustainable success and market competitiveness.

In reality, according to industry reports, the growth rates in the SaaS sector have seen fluctuations. For instance, a study by BenchmarkIt indicated that growth rates fell from the hyper-growth levels seen in 2021, with a median growth rate of 30% in 2022 compared to 42% in 2021.

This trend was observed across all company sizes, highlighting a general slowdown in the SaaS growth environment.

Why Is ARR So Important to a SaaS-Based Business?

Annual Recurring Revenue (ARR) is vital for SaaS businesses due to its ability to provide a stable and predictable revenue stream. This consistency helps companies plan budgets, allocate resources, and make strategic decisions with confidence.

Investors are particularly attracted to ARR because it demonstrates the company’s capacity to generate reliable income, which can lead to higher valuations and more favorable investment terms.

Moreover, tracking ARR offers valuable insights into customer retention and churn, highlighting the effectiveness of retention strategies and pinpointing areas for improvement. This understanding is crucial for enhancing customer satisfaction and loyalty, key drivers of sustainable growth.

ARR also serves as a critical metric for measuring growth and operational efficiency. It reflects the company’s success in acquiring and retaining customers, showing whether marketing and sales efforts are effective.

Additionally, ARR allows for benchmarking against industry peers, helping businesses set realistic growth targets and refine strategies based on industry standards. For strategic decision-making, ARR provides essential data on revenue trends and customer dynamics, guiding product development, market expansion, and pricing strategies.

In the context of mergers, acquisitions, or exits, a strong ARR is a significant factor in achieving a higher valuation and better negotiation terms, showcasing the long-term viability and profitability of the business

In a nutshell, SaaS businesses should valued ARR as a strong metric to indicate:

- Stable Income: Ensures predictable revenue for better budgeting and planning

- Investor Appeal: High ARR growth attracts investors and boosts valuations

- Retention Insights: Highlights customer retention and churn effectiveness

- Growth Indicator: Measures success in acquiring and keeping customers

- Informed Decisions: Supports strategic choices in product, market, and pricing

🎯In need of a template sheet for ARR metric report? Download this template from Equals!

Practical Tips to Increase ARR for SaaS Businesses

Here are some tips you can apply for your business plan to increase your overall ARR:

Tip #1: Enhance Customer Retention

Offer exceptional customer service to reduce churn. Quick response times and effective solutions help maintain customer satisfaction. Proactively engage with customers to address their needs and gather feedback. Regular interactions can help identify issues before they lead to cancellations.

Tip #2: Upsell and Cross-sell

Offer premium features or higher-tier plans to encourage existing customers to upgrade. Create bundles of complementary products or services to increase the overall value for the customer.

Tip #3: Optimize Onboarding Process

Simplify the onboarding process to help new users quickly realize the value of your product. Provide tutorials, webinars, and detailed documentation to help users get the most out of your software.

Tip #4: Expand Sales Channels

Establish partnerships with other companies to expand your reach and tap into new customer bases. Create affiliate programs to incentivize referrals and attract new customers through existing users.

Tip #5: Data-Driven Decisions

Use data analytics to understand customer behavior, identify trends, and personalize marketing strategies. Track key performance indicators (KPIs) such as Customer Lifetime Value (CLTV) and Customer Acquisition Cost (CAC) to optimize marketing and sales efforts.

Bottom Line

So, what is ARR in SaaS? A key financial metric that can indicate the longevity of your SaaS business. Increasing ARR is not just about numbers; it’s about creating meaningful, lasting relationships with your customers and constantly evolving to meet their needs.

Thank you for reading! Stay tuned on GO Digital’s blog for more in-depth industry knowledge and insights.

FAQs

Q1. How do you calculate ARR?

ARR (Annual Recurring Revenue) is calculated by multiplying MRR (Monthly Recurring Revenue) by 12 month:

ARR = MRR x 12 = (Average revenue per user (ARPU) per month x Total number of paying customers) x 12

Q2. What is the meaning of 100k ARR?

100k ARR means that a company generates $100,000 in recurring revenue annually from its subscription-based services.

Q3. What is considered a good ARR?

For a SaaS business, a good ARR growth rate is between 20% and 50% per year. Growth below 20% may indicate challenges in scaling, while 20%-50% suggests healthy and sustainable growth